Summary

CSSCA provides leading industry solution, which can help resolve most sophisticated problems

POM

POM

Provides the most advanced public opinion monitoring solution.

E-Revenue

E-Revenue

CSSCA e-Revenue solutions helps revenue authorities conduct overall tax management and facilitates taxpayer services

Customs

Customs

Simplifying the key customs processes to help involved parties shorten declaration time

E-Government

E-Government

Empower government with science and technology and the most advanced technology solutions to meet various challenges

Transportation

Transportation

Provide comprehensive solutions to improve urban traffic supervision and vehicle utilization, build smart transportation, and smart cities.

Taxation

CSSCA tax solution uses advanced big data and blockchain technology, combining with specific business needs of taxation, which can help tax authorities effectively improve overall taxation management capabilities and service, increase tax revenue.

Integrated taxation administration solution

Taxpayer registration, tax bill management, tax payment, financial management, compliance check, audit

E-invoice cloud platform

E-invoice issuance, E-invoice receipt, ERP system integration

Taxpayer service platform

Online registration, online declaration, online inquiry, online payment

Integrated Taxation Administration System

Provide professional business flow consultancy service

Integrated Taxation Administration System

Provide professional business flow consultancy service

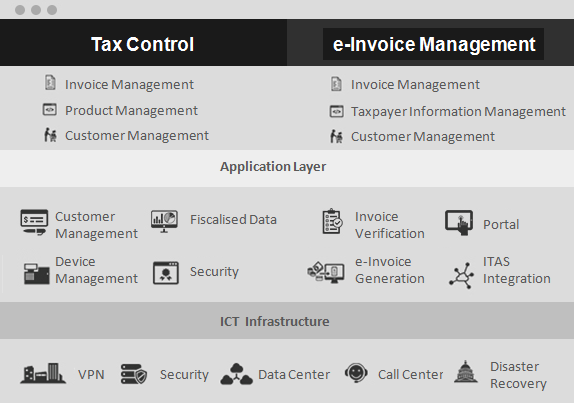

Taxation-TCS

The tax control system provides a solution based on transaction circulation, which can improve the business tax payment of SME taxpayers. The solution aims to create an e-invoice management framework that connects the business invoice system to the tax authority's system in real time. Enabling tax authorities to collect taxpayer sales and purchase information through a dedicated network and accurately calculate taxpayer turnover.

The advantages of the TCS system

Unified invoicing and supervision of invoices, standardizing taxpayer invoicing behaviors, preventing fraud

With automatic declaration, ensuring that taxpayers pay taxes in accordance with the law, increasing the collection rate, providing multi-channel, personalized, comprehensive tax services, reducing tax costs

Providing a set of symmetrical encryption data transmission scheme combined with asymmetric encryption, ensuring the security of data transmission while taking into account the performance of business processing

Adapting to the tax law changes through the flexible configuration of the system

ITAS tax management system is a comprehensive solution designed to provide a wide range of services, including online registration, declaration assessment and personal income tax audit, corporate income tax and value-added tax audit.

ITAS program features:

Workflow and SOA ensuring system scalability and adaptability

By automating business processing, reducing collection and management costs, providing in-depth data analysis capabilities, improving the fine-grained management capabilities of tax data

Providing tax services, and providing basic data for decision analysis

With a good user interface, easy to use

Providing an integrated tax management platform, and standardizing tax administration

Improve tax efficiency and enhance taxpayer compliance management

Smart customs

The role of customs around the world has shifted from focusing on taxes and import duties to trade facilitation and reducing administrative burdens. Smart customs solutions can greatly promote tax revenue and ensure that taxes are collected in full and on time; improve the efficiency of supervision, improve the tightness of supervision; improve the business environment; achieve uniform law enforcement, and promote data interconnection between countries.

Customs single window

01

Realization of one-point access and one-time submission by the applicant through the electronic port platform, meeting the requirements of port management and international trade authorities in standardization

02

Realization of one-point access and one-time submission by the applicant through the electronic port platform, meeting the requirements of port management and international trade authorities in standardization

03

With continuous optimization and integration, the scope of the "single window" function has covered all major links in the international trade, and has gradually become the main access service platform for enterprises working with relevant departments of port management.

04

Improve the interoperability between the systems of the parties involved in the international trade supply chain through the "single window", optimize customs clearance business processes, improve declaration efficiency, shorten customs clearance time, reduce corporate costs, and promote trade facilitation

Customs Electronic Cargo Tracking System

ECTS is mainly based on RFID and GPS technology. The system can accurately locate the electronic lock position through RFID technology and lock the electronic lock to ensure the safety supervision of the goods on the way. Through precise positioning, it can ensure that the container and the electronic lock can match with each other.

Customs iGate

As the portal of customs supervision, the smart iGate system plays a vital role in the circulation of goods and customs supervision. The customs must automatically identify and manage the goods entering and leaving the supervision area, and inspect or release them in accordance with customs regulations. The iGate is the hub that monitors the entry and exit of goods to and from the customs. It is a key checkpoint for customs supervision. It is an important part of the logistics supervision, forming a two-in-one logistics and customs information flow.

01

Realize vehicle and cargo information collection and vehicle control

Front-end

system

1.Container recognition subsystem

2.Vehicle license recognition subsystem

3.Release control subsystem

4.QR code recognition subsystem

02

Realize data transfer among front-end collection system, cloud platform and logistics platform

Cloud

transmission

Protocol transfer, message transfer, adaption, load balance, monitoring.

03

Monitor real-time data and manage visualized maintenance with data mining

Cloud platform

Parameter management, authorization management, photo management, worl flow management…

Government

The government and relevant state agencies aim to protect citizens and improve their lives. Advanced ICT technologies can be applied to internal and external processes in all government departments.The key drivers are:

Business process automation: Reduce manual operations, reduce costs and improve the overall efficiency of government processes.

Reduce rising operating costs: Adopt comprehensive technical solutions, reduce maintenance and personnel costs.

Innovation and practice: deploy comprehensive solutions through a comprehensive approach to meet unique needs faster and more efficiently

E-government solution

1.Office automation

5.National ID management

2.Tax management

6.Visa management

3.Incident management

7.Side control

4.Server

Strengthen citizen services: implement advanced information technology to provide better, more comprehensive and targeted services to the public, while ensuring information transparency

Optimize the utilization of existing assets: apply long-term IT strategies, control available budgets while developing technology, and adapt changes to existing systems

These drivers represent the technical and operational requirements of the modern government to provide public services to its citizens. As a leading ICT service provider for e-government, CSSCA fully understands the requirements of modern governments and provides comprehensive solutions to help governments meet various business and technical challenges.

Traffic

Today, a sound transportation system makes our lives easier and more efficient. However, due to the rapid population growth, many cities are facing the challenges of congestion and rising levels of air pollution. The traditional mode of transportation construction is far behind the rapid development of modern society. There are also many challenges:

How to use advanced technology to establish urban transportation systems, reduce traffic pressure

How to establish timely and effective supervision mechanisms

How to accurately locate and track vehicles and personnel

How to quickly find abnormal information, and combat crime

How to establish integrated systems to achieve multi-dimensional management, reduce air pollution, noise pollution, etc.

Smart transportation is a tool that enables urban transport network operators to manage transportation to achieve policy goals. It can have a positive impact on traffic throughput, pollution control and safety. As a leading ICT service provider, CSSCA has extensive experience in the transportation industry and provides comprehensive solutions. We help customers manage and control transportation systems, reduce congestion, maximize the efficiency of road networks, optimize service levels, and improve overall transportation efficiency.

Solution

City traffic monitoring

Vehicle tracking

Beijing transportation administration authority

Beijing vehicle recognition system

Mongolia safe city construction service

Safety public opinion supervision

Public opinion is the actual situation of public opinion, and is the public's willingness and attitude, including the public's understanding or views on various political and social phenomena and issues. It is the sum of mass psychology, emotions, needs and thoughts. Public opinion monitoring, including online public opinion clues, analysis and judgment, real-time warning, event tracking, and comprehensive reporting, can turn passive to active.

5 Key functions